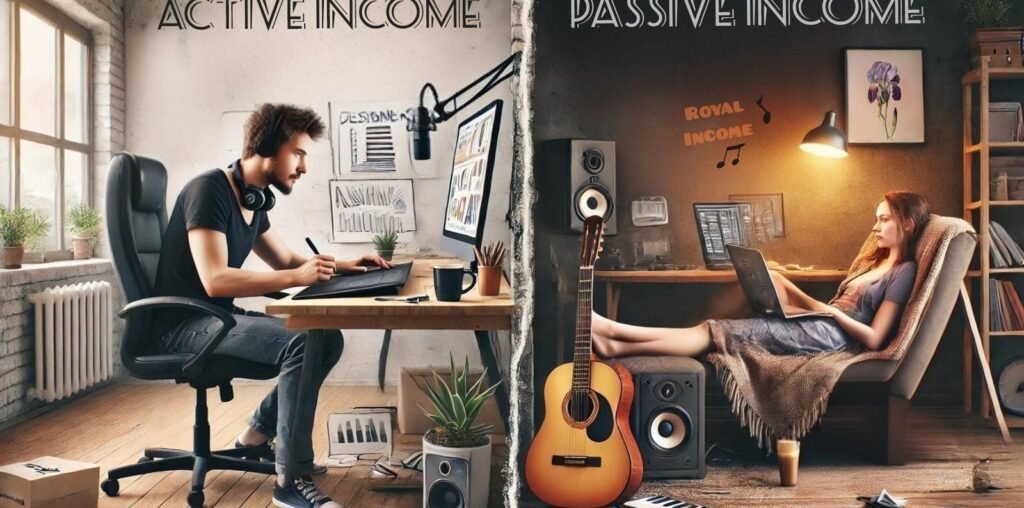

If passive income is the golden goose, active income is the farm where you do the daily work to earn your keep. While many people dream of replacing active income with passive income, the truth is, you need both—especially at the beginning.

This post will help you understand the key differences, so you can balance both for maximum financial success.

What Is Active Income?

Active income is money earned from your direct efforts—your paycheck, freelance gigs, or business work. If you stop working, the money stops flowing.

Example: Tom, a graphic designer, earns $3,000 per project. If he stops designing, his income stops. That’s active income.

Example: Tom, a graphic designer, earns $3,000 per project. If he stops designing, his income stops. That’s active income.

- Instant Reward: You get paid quickly after working.

- Predictability: A regular salary helps with budgeting.

- Skill Development: Active income sources often improve your expertise.

Cons of Active Income:

- Time Dependency: No work = no money.

- Limited Scalability: There are only so many hours in a day.

- Burnout Risk: Working constantly can be exhausting.

What Is Passive Income?

Passive income, as we covered earlier, continues flowing even when you’re not actively working. But it often requires time or money upfront.

- Freedom from Work: You don’t trade time for money.

- Wealth-Building Potential: Can grow significantly over time.

- Diversification: Passive income adds financial security.

- Setup Required: It takes time or investment to build.

- Slow Growth: Passive income isn’t an instant paycheck.

- Risky: Some sources require good planning to be profitable.

Finding the Right Balance

The key isn’t choosing one over the other—it’s using both wisely.

Which Should You Focus On First?

- If you need immediate cash, focus on active income first.

- If you have extra time or money, start building passive income streams.

Final Thoughts

Active income keeps the lights on, but passive income builds financial freedom. The trick is to balance both until you reach a point where passive income supports your lifestyle.